Per diem allowances for business travel

Did you know that business travel is one of your largest overheads? Let’s build a great expenses process!

Read now

Our online calculator works out exactly how much you’re entitled to spend when you travel for work.

Simply enter your travel dates and details to find out your per diem allowance.

Or click on the state on the interactive map to see the per diem information for that state

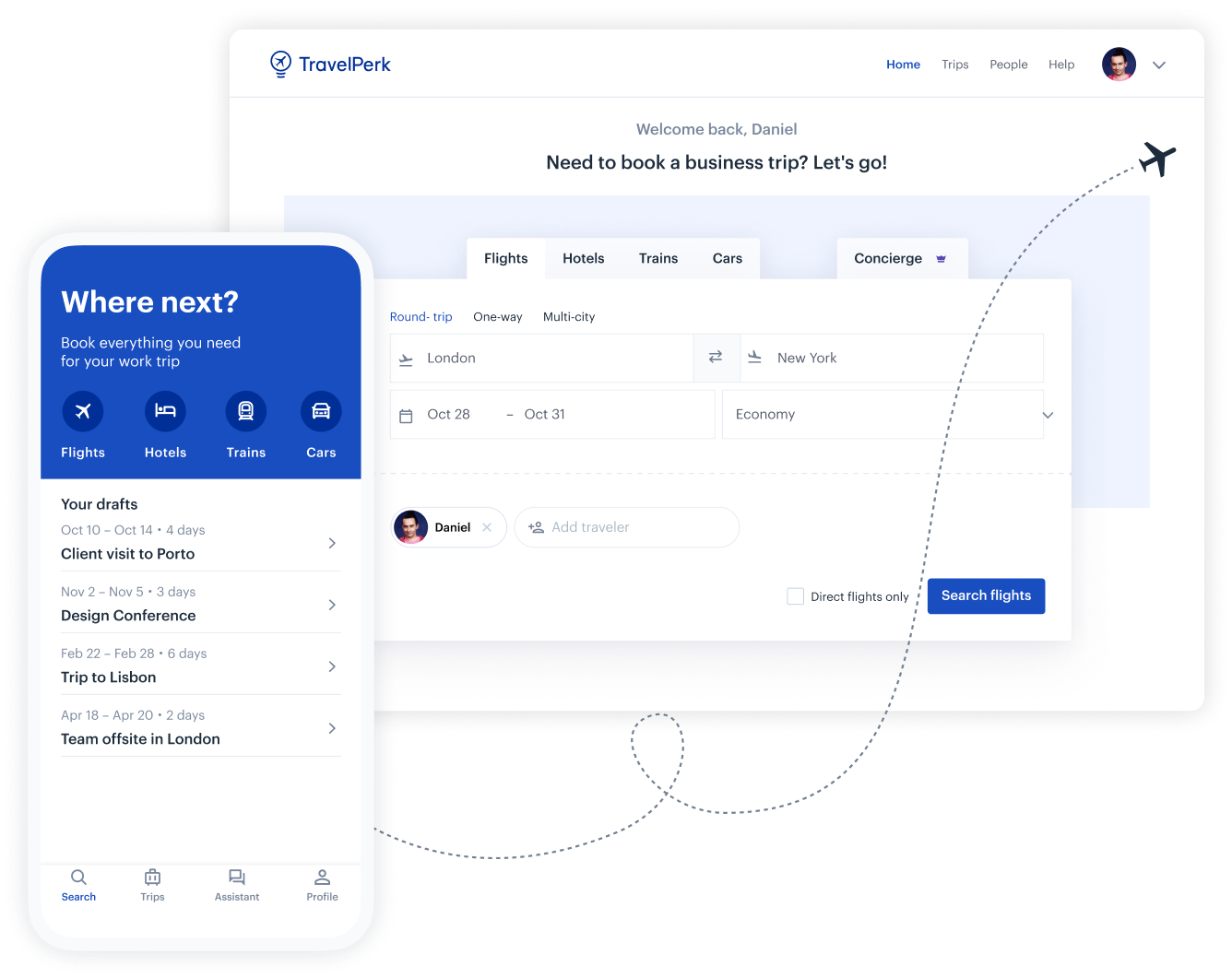

Book, plan, and manage your business travel with our simple, easy-to-use travel management tool.

A per diem is a fixed amount paid by an employer to employees to cover travel expenses while traveling for business. Expenses claimed under a per diem must be essential to an employee’s job performance. Per diem payments are used to cover expenses like meal costs, travel expenses, and accommodation. The US government provides official travel benchmark allowances that consider things like average lodging costs, general cost of living, and travel regulations. But individual cases can be assessed based on typical costs.

In the United States, per diem payments are set and regulated by the U.S. General Services Administration (GSA). The Internal Revenue Service (IRS) separates expenses into ‘lodging’ and ‘meals and incidental expenses.’

Employers can choose to reimburse employees using standard set rates for each state, or using a calculated ‘high-cost’ per diem rate for more costly locations.

Some states have multiple rates depending on which city the employee is traveling to. The current rates are $292, with $71 assigned for meals on the high-cost rate, and $198, with $60 assigned for meals on the low rate.

International per diem rates are set out here.

In the US, no federal laws exist that require employers to cover employee travel expenses. However, there are other regulations that may require employers to reimburse employees for travel costs. Even if companies aren’t required to reimburse employees for travel expenses, it’s good business practice to do so, especially considering the IRS allows employers tax deductions for travel expenses.

It’s generally up to employers to decide how to pay per diem, and whether it should be paid before or after employees travel. There are a few different options.

These are: upfront payment, partial upfront payment, or reimbursement after employees have traveled.

Per diem rates are not counted as income for employees so they are not taxable. But, if a per diem rate goes over the standard or agreed amount, it’s considered a taxable benefit to employees.