A guide to corporate mileage reimbursement policies

Read now

Having employees use their own vehicle for work can be expensive. Especially if they regularly drive long distances and spend money on fuel. Now you can quickly calculate how much your employees can get back with our easy-to-use mileage reimbursement calculator.

Each country has its own standard mileage allowance. The rate is updated every year by the countries tax authority and is meant to cover all costs of owning and running your vehicle for the business-use part of your driving.

Stay up to date with the ultimate mileage reimbursement guides.

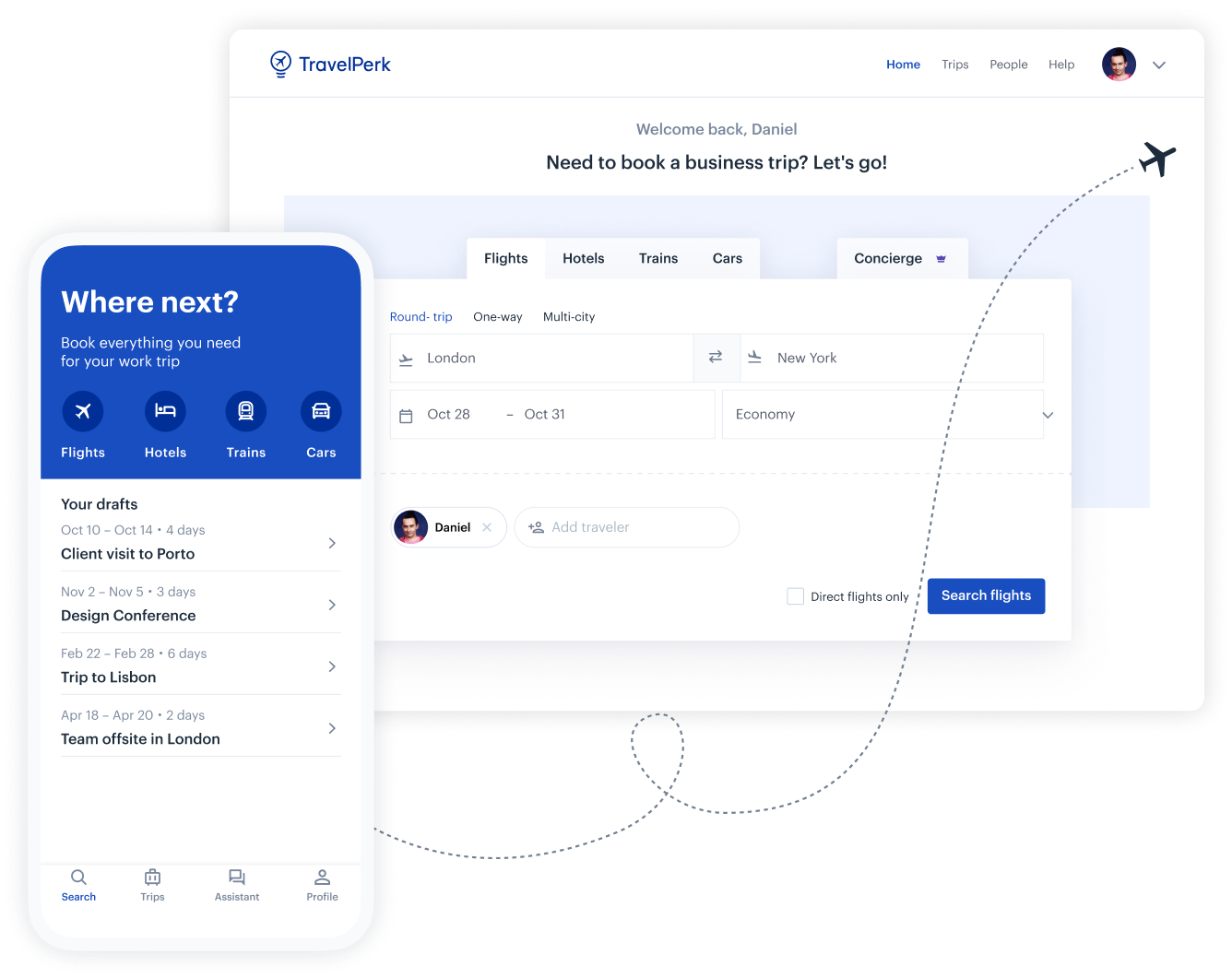

Book, plan, and manage your business travel with our simple, easy-to-use travel management tool.

When an employee uses their personal car or van for day-to-day business activities, they can claim back the cost without paying income tax.

Mileage reimbursement isn’t designed to cover commuting to and from work. It only covers journeys that employees are requested to make during work, specifically those with a business purpose.

In short, no. In most countries there is no requirement by law to reimburse an employee’s mileage or other travel expenses. However, many companies do, as a matter of good practice.

Although each country has its own standard mileage allowance, the rates can differ depending on each company and how much they choose to pay back their colleagues. Companies can also set their own mileage reimbursement policies.

Yes, companies can choose to reimburse a higher amount than the standard. However, this does come with its own rules and regulations.

For example, in the U.S. and UK, if they exceed the standard mileage rate, the reimbursement will count as regular wages and lose its tax benefits (if they go below the rate, employees in many countries can deduct their difference when filing their tax return).