Thanks to the world’s largest business travel inventory

Reclaim VAT on staff expenses

Get the low-down on reclaiming VAT on staff expenses

Read more

Our handy online calculator lets you calculate how much VAT you can reclaim in up to 30 countries.

Last updated 01.04.23

Enter the gross amount (including taxes) spent for each category to see how much you could reclaim.

TravelPerk's VAT Calculator

Country

Domestic flight

Train

Hotel

Car rental

Potential recovery

- Local / - $Home

Total amount of VAT you could reclaim

- Local / - $Home

*The estimates and rates shown on this page are indicative only, and based on the rates published by the EU on the date mentioned at the top of the page. Countries may change rates at any time or offer discounted rates for a short period of time. Recovering VAT is subject to local regulations.

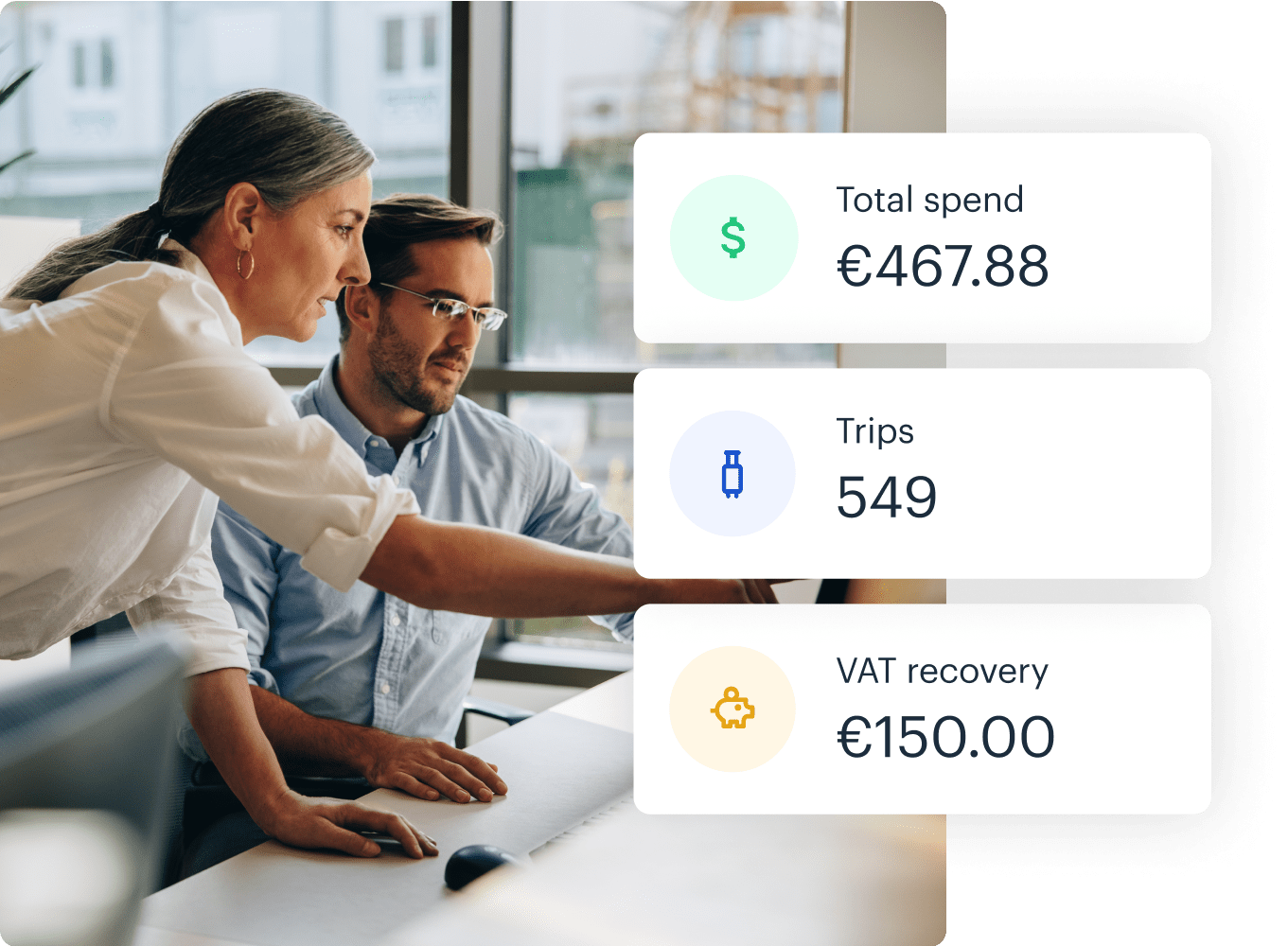

Book your business trips with TravelPerk to make it easy to get up to 25% of your spend back. The VAT reclaim process has never been quicker or easier.

VAT (Value Added Tax) is a sales tax levied in goods and services. In some countries this is called GST (Goods and Services Tax).

The United States does not have a national VAT rate. Instead, the Sales Tax varies from state to state.

VAT/GST registered businesses can claim VAT back on certain goods and services, certain types of travel. Businesses send a VAT return to the tax authority of their home country.

This depends on your home country. In the UK, repayments are usually made within 30 days of HMRC receiving your VAT return.

Businesses can still reclaim their VAT by filing a return with their home tax authority.

Yes. Depending on your country or region, you can claim VAT on domestic business travel.

Yes, you can recover VAT on business travel in foreign countries, even those where you do not have a VAT registration. Depending on the country, you may be able to claim on hotel stays, plane. taxi, train or hotel, as well as your food.

Your entitlement to recover VAT is based on the rules in the country where the trip takes place. For example, VAT is generally not recoverable on hotel stays in Ireland, and this rule applies the same to an Irish company as it does to a company which is VAT registered in another country e.g. UK company. However, as the rules are based on where the trip takes place that means that the same Irish company could recover VAT on UK hotels. This is because VAT is recoverable on UK hotels (subject to UK VAT rules).

By recovering the VAT incurred on trips when employees travel abroad for business you can reduce the cost of travel by between 5% and 25%. The mechanism for recovering foreign VAT is different to recovering domestic VAT but TravelPerk can help you with this process.

This depends on the country in which the hotel is located. The VAT rules are different from country to country. TravelPerk can help you calculate the amount of VAT your business can recover on travel related costs, and help you recover VAT ready invoices from most hotels.

Yes. You can reclaim all the VAT on fuel if your vehicle is used for business purposes.

You can reclaim VAT on employee travel expenses for business trips, including meals and accommodation. Note that you cannot reclaim VAT if you pay your employees a per diem/flat rate for expenses.

Per diem payments are daily allowances paid to employees to cover costs incurred while on a business trip. Companies typically offer per diems in the form of company credit cards, full or partial expense coverage, or fixed daily rates. Business expenses typically include accommodation, transportation, food, and any other incidental expenses. If you offer a per diem fee to your employees you cannot reclaim VAT on their trip expenses.

In order to recover VAT on business travel, you will need a valid VAT invoice in the name of your company. Without a VAT receipt, a refund is very unlikely. TravelPerk creates VAT compliant invoices for plane, and train trips and can help you collect VAT invoices for your rental car and hotel bookings, and can connect with your expenses app.

TravelPerk maintains a VAT-friendly inventory of services. When you book, you can be confident of claiming a VAT refund from your business travel. We also handle VAT invoice collection and ensures these invoices are VAT-compliant. You can use the VAT calculator to estimate your VAT refund. TravelPerk also has a team of VAT specialists ready to provide extra assistance.

TravelPerk, the world’s leading online travel management platform makes it easy to control your spend.