Travel and expense management is a massive undertaking, whether you have 50 employees who travel for business or 5,000. Accurately collecting and reporting on all travel-related expenses is a challenge for finance managers worldwide.

Fortunately, in recent years, things have changed. Today, modern software eliminates the need for paper expense reports, manual reimbursement processes, and back-and-forth approvals.

In this guide, we dive into travel and expense management. We showcase the signs that your processes may not be up to date, and the solutions available to help you improve your processes.

All about travel expense management

Travel and expense management (T&E) is the process of collecting all travel-related expenses in order to write them off (and not pay taxes on that amount). In most countries, business-related travel, including flights, hotels, and ground transportation is fully expensable.

Whether or not food purchases are fully expensable depends on the country. In the US, food and beverages are 50% deductible, whether the expense is incurred during an event, a business trip, or a client dinner in your home city. Meanwhile, in the UK, food and beverages are fully deductible.

While the rules may differ by country, one thing holds true: tracking all deductible expenses is essential for lowering a company’s tax liability. T&E software is designed to accurately track these expenses for tax write-offs as well as financial analysis. With the right data in place, smarter budgetary decisions can be made.

Pain points of ineffective T&E processes

If your travel and expense management processes are inefficient, your company will experience a lot of frustration.

Are you dealing with some or all of these? Take it as a clear sign that it’s time to change the way that you manage your expenses.

- Lack of visibility into real-time travel spend: When your expense processes are slow, that means your data collection is slow too. Finance managers and budget owners who can’t get instant insights into spending can’t make informed decisions for that time period. Instead, all of their budget optimizations will be reactionary.

- Lack of control and autonomy for travelers: The old-school way of T&E management is all about control. An office manager or travel manager will book all trips to ensure that they’re within budget. But this frustrates travelers, who would rather book their own trips than send back-and-forth emails.

- Requirement for travelers to pay upfront: Without a travel management platform and corporate credit cards in place, travelers will have to pay for things upfront and file a reimbursement request later.

- Requirement for travelers to fill out expense reports: Without modern tech, travelers will either have to fill out a paper expense report or manually enter the data into an outdated system.

- Office managers struggling to wrangle all invoices: If your company isn’t booking travel in one place, you’ll have dozens or even hundreds of vendors each month to collect invoices from for your tax preparation.

- Finance managers struggling to reconcile purchases: Without automated reconciliation in place, finance managers will have to reconcile expense reports with corporate credit card purchases.

- Tedious reimbursement tasks: If you’re using paperwork or outdated tech, reimbursements are processed manually with payment vouchers.

- Lengthy reimbursement fund processing for travelers: Slow processes mean that travelers don’t get reimbursed right away. Especially if they had to make a large purchase, this could be challenging for managing their own personal finances.

If you allow these issues to continue, your business travelers will feel like you don’t trust them, and your administrative and finance teams will be too bogged down with manual work to tackle strategic business initiatives.

6 Small business travel expense management challenges

High processing costs and inefficient processes are just some of the challenges facing small businesses without a travel expense management solution to help them streamline and improve the accuracy of their expense processes.

Here are just a few of the main challenges that small businesses face across the travel expense management process.

Inaccurate expense report submissions

Expense report processing is a costly process, especially when these processes need to be repeated due to inaccurate and/or late expense form submissions. Outdated, manual systems consist of slow and laborious submission workflows, as well as multiple opportunities for human error. Plus, a surefire way to reduce employee productivity is to make them fill out multiple complicated finance forms that they don’t fully understand.

Lost receipts and other travel documents

The loss of paper receipts is a huge challenge for those in charge of small business expense management processes. When employees lose receipts, your business cannot reimburse them for the expenses they incurred during business travel since there is no proof that the expense occurred. Plus, if you do choose to go ahead and reimburse employees without receipts, you risk compliance issues with the IRS, since receipts are important for tax deductions and auditing.

Unauthorized bookings

When you rely on manual processes, unauthorized travel bookings can easily slip through the cracks. Even though you might have pre-approval processes in place, it can be difficult to identify which bookings fully comply with your travel expense policy guidelines. Travel expense management solutions, on the other hand, help you to set specific parameters for each business travel booking and can alert you when bookings out of policy are made.

Paying too much for business travel

Every business wants to keep travel costs down. However, smaller businesses might find it more difficult to establish corporate partnerships with hotels and airlines to get the best deals.

There are a variety of small business travel services on the market that not only provide an innovative online booking platform, but a chance for your team to save money and streamline the way you book corporate travel.

These platforms offer extensive accommodation inventories and corporate flight inventories from which you can search, book, and manage bookings from within the platform to help you save money on travel costs.

Lack of access to travel expense data

Manual travel expense management processes prevent you from gleaning insights and data into your travel costs and expenses. Not only can this manually managed data be recorded inaccurately, but you also cannot access a true level of visibility into how much you’re spending, nor your biggest expense categories.

Without a clear oversight, you can’t make informed business decisions or predict and plan for future travel costs. Plus, instances of expense fraud can easily go unnoticed.

No comprehensive travel expense policy to refer to

A key reason businesses face issues when managing travel expenses is that they lack a comprehensive travel policy. Without a policy that clearly outlines your guidelines on business travel expenses, including rules on accommodation, meals, entertainment, and reimbursement processes, the entire process becomes unwieldy, expensive, and inefficient.

Every company that engages in business travel needs a solid travel expense management policy to help eliminate any confusion over what is and isn’t covered, and how and when employees will be reimbursed.

What effective T&E processes look like

When you have easy-to-use and powerful software to help you manage your corporate travel expenses, you can switch all of those negatives into positives.

- Full visibility into real-time travel spend: With automated expense reports via a mobile app, as well as consolidated travel booking, your finance team will have real-time expense tracking to help them better understand your travel program.

- Options and autonomy for travelers: Whether at a small business or a large corporation, business travelers want to choose their own trip options. This is a more enjoyable experience and helps them feel trusted.

- No need for travelers to pay upfront: Business travel purchases shouldn’t require that travelers request a reimbursement. Flights and hotels especially can be expensive. When booking on a business travel platform, the company can pay the monthly invoice and the travelers don’t have to pay upfront for each trip.

- No need for travelers to fill out expense reports: The right expense management solution will streamline all expense workflows with automation. A mobile app can scan receipts so travelers don’t have to manually enter data into the expense management tool.

- Fast for office managers to collect invoices: When you consolidate your travel costs into one corporate travel management system, you reduce the number of invoices. Your business travel platform should give you just one invoice at the end of each month.

- Automated purchase reconciliation: Expense data from receipt scans and corporate credit card purchases should be automatically reconciled.

- Automated reimbursement approvals: You should be able to automate your expense policy with rules so that food or taxi purchases under a certain pricing can be automatically reimbursed with no need for approvers to manually review.

- Quicker reimbursement funds for travelers: With automated reimbursements, travelers can get their funds quicker. And with consolidated business travel booking that the company pays for, travelers won’t even need reimbursement most of the time.

The best systems for travel and expense management

To manage your travel expenses accurately, you need the right corporate travel and expense management software. An enterprise resource planning (ERP) solution that isn’t purpose-built for travel won’t cut it. In fact, you need two different programs that are fully integrated, a travel management platform and an expense management software.

Travel management platform

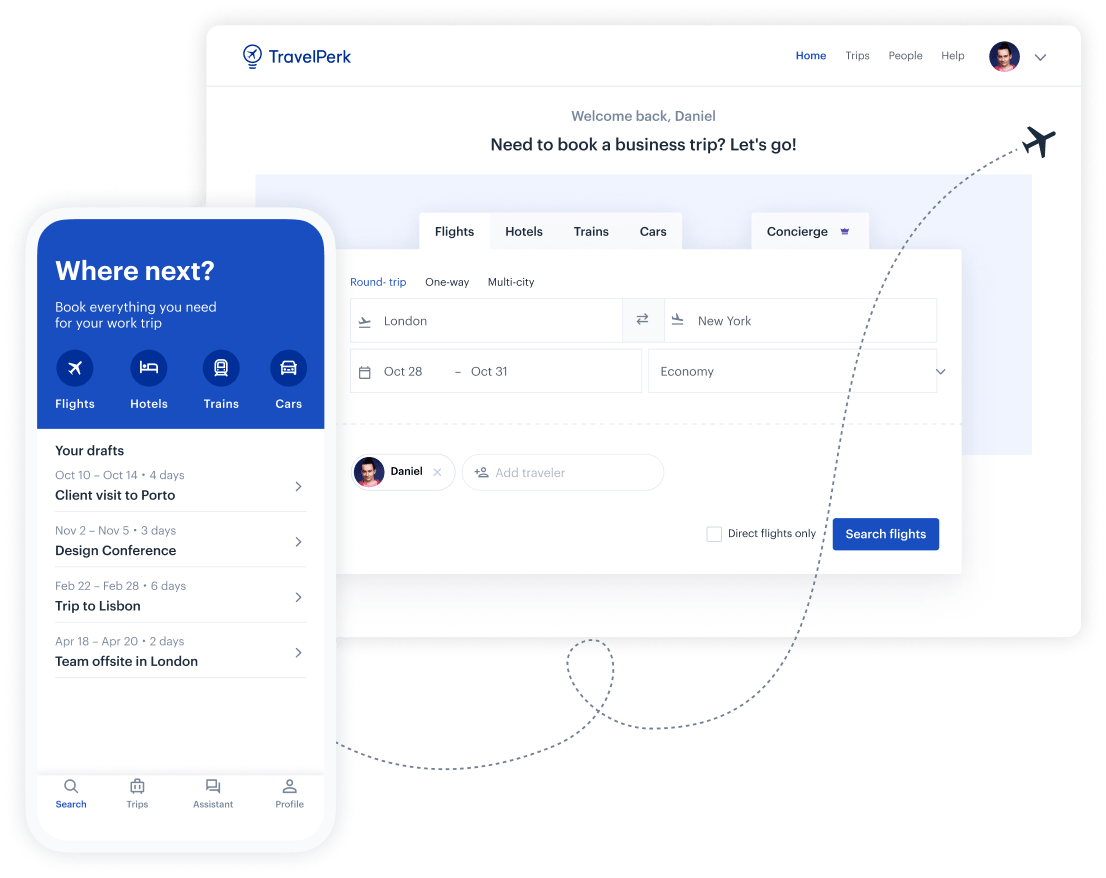

You need a travel management platform to help you control company travel, without actually micromanaging anyone. A modern travel management platform allows you to create customizable travel policies that work at the time of booking. This is not just a static travel and expense policy document.

A business travel platform also reduces manual work associated with business travel, because travelers can book for themselves and choose the options they want within policy, so there are no complicated approvals. What’s more, there’s no need for reimbursements, as a business travel platform should consolidate spend into one monthly invoice for the finance team to pay for.

What to look for:

- Great trip inventory (every option you can find in Google)

- Customizable travel policies and approvals

- Monthly invoice to consolidate payments

- High-quality customer support

- Insightful travel spend analytics and reporting

- Easy-to-use mobile app for travelers

- Consumer-grade UX (so travelers want to use the app, which leads to policy compliance)

Travel and expense management that works like a dream

Expense management platform

On the other hand, an expense management platform doesn’t actually help you purchase travel. Instead, it pulls all transactions from company credit cards into one place. It also securely stores your receipts and invoices for tax preparation. And, expense management systems also provide complex analytics and simplify the reporting process.

Make sure to choose a modern SaaS version that works in the cloud on any device. This way, employees can use their mobile phones to scan and upload receipts.

Some purchases require reimbursement. For example, if a traveler pays a local taxi company. Your expense management platform should help speed up reimbursement processes, and reduce manual work.

What to look for:

- Receipt scanning to reduce manual data entry

- Expense approval and reimbursement workflows

- Rules and automatic approvals for low-cost expenses

- Easy-to-use mobile app for employees

- Corporate card integrations and data importing

- Expense reporting and analytics

Let’s take a look at some of your options.

3 Top travel expense management solutions

These travel expense management solutions help you get full visibility over your company spending and improve the employee experience for your traveling employees. It’s essential to consider your location, as different countries have different rules and regulations regarding business expenses. Here are our top three picks, each serving a different region.

1. Divvy: for the US

Divvy is expense management software that provides physical and virtual cards and an online expense management platform. It helps small and midsize businesses in a wide variety of industries to adhere to spend limits and manage employee expenses efficiently. Here are some more details on Divvy and what you can expect:

- Business credit: access the funding you need with credit lines up to $15m available to businesses of all sizes.

- Rewards: get rewards on restaurants, hotels, travel, and more for spending with Divvy.

- Languages supported: English

- Pricing: Free. There are no annual fees, no monthly fees, no initiation fees, and no hidden fees. Divvy takes a cut of the merchant’s fee whenever you spend using Divvy—allowing them to build and provide the expense management software for free.

The solution gives business real-time visibility into spending and flexible controls for seamless spend management—even when it comes to corporate travel. Divvy integrates with TravelPerk to provide US-based SMBs with an online portal for booking, managing, and reporting on corporate travel.

2. Pleo: for the UK

Pleo handles expenses, invoices, and reimbursements so that you don’t have to. Free your team from admin by automating key tasks, get your money back with 1% cashback, and stay in control with spending analytics and limits.

Pleo also integrates with TravelPerk to simplify travel expense reporting. Simply make a booking on TravelPerk using your Pleo card to automatically reconcile your expenses and receipts in Pleo. It enables you to save time and reduce manual errors, track travel costs in real-time, and set individual spend limits and travel policies.

Here’s what else Pleo offers businesses:

- Invoice management: Pleo integrates with invoicing software to automate the invoice payment process and offer comprehensive spend visibility.

- Speedy expense reimbursement: easily track out-of-pocket expense claims to ensure employees are reimbursed quickly and in line with your company’s policies.

- Languages supported: Danish, German, English, Finnish, French, Dutch, Norwegian, Portuguese, Spanish, and Swedish.

- Pricing: Pleo offers three pricing plans:

- Starter: free

- Essential: £39/month

- Advanced: £69/month

Pleo simplifies business expense management for businesses big and small.

3. Yokoy: for DACH

Yokoy is an AI-powered spend management solution that consolidates and automates all accounts payable processes on one platform. Here are some more details:

- Individual solutions: Yokoy services and products are available individually or as a pack. Only buy what you need.

- Automated approval and travel expense reporting: the AI-based tool analyzes and approves standard expenses and automatically creates expense reports as you spend.

- Languages supported: German, English, French, Italian, and Chinese (Simplified).

- Pricing: Custom pricing based on requirements.

Alongside your day-to-day business expenses, Yokoy integrates with TravelPerk to manage your business travel expenses. Bookings made via the TravelPerk platform are automatically transferred into Yokoy, where employees can easily add travel expenses incurred during the trip.

Finding an expense management solution that integrates with your travel management platform is key for spending visibility and management. These top three expense solutions ensure you’ve got all the data you need to manage and report on business spending.

We caught up with Katharina Wodischeck from adsquare to hear her thoughts on Travel & Expense management.

How important do you think it is to have visibility on a company's travel expenses and why?

"With having a clear visibility on travel expenses, a company is able to accurately track travel spends, and therefore budgeting and forecasting can be made more precisely. Beside that, the visibility gives the opportunity to analyse expenses by travel category, departments, and therefore helps streamlining the reporting process. And finally, having insights on the travel spend helps the company to create effective expense policies."

In your opinion, what are the biggest challenges in managing T&E?

"In my opinion, one of the biggest challenges is that too many businesses are still managing T&E using excel sheets and therefore wasting a lot of time for manual processes and reconciling receipts. That lack of visibility makes it difficult for finance teams to identify which employees incur what expenses. Another challenge I see are unclear T&E policies. This can lead to unexpected and unauthorised purchases and moreover to consequences in terms of cost control and overseeing travel budgets."

What advice would you give to someone who's struggling with managing their company's travel expenses?

"My advice would be to find a technical solution and therefore to automate the process as much as possible. It would make sense to capture all travel bookings and expenses in one system and enable all employees to manage travel bookings and expenses on their own according to the corporate travel policy."