Managing business travel expenses is no easy task, and doing it wrong can lead to some pretty hefty consequences. Employee travel will likely lead to travel expenses, and it’s your responsibility to ensure everything is done by the book.

There are many ins and outs, so here’s our guide to ensuring you’ve got your eye on the ball when it comes to employee travel and per diem allowances.

What is a per diem allowance, and what does it cover?

A per diem, also known as a scale rate payment, is a fixed amount paid by an employer to an employee to cover incidental expenses incurred while traveling away for business purposes. When claiming travel expenses, just like any business expense, the key rule is that it must be essential to the performance of your employees’ job in relation to business objectives.

Per diem payments are typically used to cover expenses like meal costs, travel expenses, and lodging expenses—even dry cleaning. The government provides official travel benchmark allowances that consider things like average maximum lodging costs, the general cost of living, and travel regulations. However, individual cases can be assessed based on typical costs.

Who sets per diem rates in the UK?

In the UK, per diem payments are governed by HM Revenue and Customs (HMRC)—who modulate the payroll system, rules, and travel allowances for a company’s employees.

There are two ways in which HMRC allows you to set up per diem payments:

- Agreeing on a per diem rate with HMRC by providing past typical expenses

- Using HMRC's benchmark per diem rates

HMRC also provides benchmark rates for employees traveling outside of the UK for international business. Per diem rates vary depending on the destination country and the country in which the company is based.

Who sets per diem rates in the U.S.?

In the continental United States (CONUS), which includes Alaska and excludes Hawaii, per diem payments are set and regulated by the U.S. General Services Administration (GSA).

The Internal Revenue Service (IRS) separates expenses into 'lodging' and 'meals and incidental expenses (M&IE)'—important to acknowledge if you're heading to the continental U.S.

Employers have two options when deciding how to reimburse employees:

- Standard rates: these are different rates for each state and individual location.

- High-low method: locations deemed ‘high-cost’ are assigned a per diem rate, with all other states taking the ‘low-cost’ rate.

Standard rates can be checked here, and some states have multiple rates depending on which city the employee is traveling to. If using the high low method, the current rates are:

- High-cost: the full rate is $292, with $71 of that being for meals and incidental expenses

- Low-cost: the full rate is $198, with $60 of that being for meals and incidental expenses

If you’re a U.S.-based company, international per diem rates are managed by the U.S. Department of State—check them here.

Find out your per diem allowance for your upcoming U.S. trip

Our per diem calculator works out exactly how much you’re entitled to spend when you travel for work.

What are the benefits of per diem allowances?

Per diem allowances provide employees with a certain amount of flexibility and trust when traveling for business. They reduce expense volatility and facilitate planning for a business trip and decrease the administrative burden on both the employee and employer.

Per diem allowances often promote prudence in business travel, as costs are restrained by the agreed allowances. They also encourage professional development—employees are far more likely to travel for learning opportunities if their expenses are covered.

What are the drawbacks of per diem allowances?

While flexibility and prudence are beneficial, they can also be detrimental if unmonitored. If employees begin to consider their per diem allowances part of their income, they may cut corners to pocket the change from actual expenses.

Internal governance systems can be put in place to monitor this. However, this offsets the administrative benefits of per diem payments. It’s also possible that employee travel could increase unnecessarily due to per diem allowances—traveling for meetings is more attractive when you’re essentially paid a little extra to do it.

How do per diem allowances work?

When an employee goes away on business, the company has to ensure their per diem allowance is available. Whether it’s the benchmark allowance or an HMRC-agreed amount, they need reassurance that their expenses are covered.

Traditional expense reporting can be tiring for both the employee and the travel manager. On the one hand, the employee must compile all travel expenses into an expense report. On the other hand, it’s the company’s (or travel manager’s) temporary duty to monitor and remain vigilant of business expenditure when trusting their employees.

Per diem payments, however, provide the employee with a daily allowance in advance. It avoids the paperwork, given it remains within the standard rate, and reduces waiting time for employees claiming reimbursements for travel expenses, as their spending is pre-approved.

How is per diem paid to employees?

How employees receive their per diem payments is up to the company and can be one of a few options:

- Cash in hand: The employee receives the per diem payment upfront to use when necessary.

- Corporate credit cards: These can have limits and be monitored to ensure no employee misuse.

- Private spend: The employee uses their own money and is reimbursed upon return or regularly—like the last day of every month—if it’s a longer trip.

What are the current per diem allowances in the UK?

For employee travel to be covered by per diem payments, the expenditure must qualify as per the HMRC-established conditions:

- The travel must be in the performance of an employee’s duties or to a temporary workplace.

- The employee should be absent from their normal workplace or home for a continuous period of over 5 or 10 hours.

- The employee should have incurred a meal cost (food and drink) after starting the journey.

If these conditions are met, the current HMRC benchmark per diem rates in the UK are:

- £5 for qualifying travel of 5 hours or more

- £10 for qualifying travel of 10 hours or more

- £25 for qualifying travel of 15 hours or more and where the travel is ongoing after 8pm

However, these are subject to change, so it’s essential to keep up with allowances for business expenditure and daily rates. There are no benchmark rates for overnight accommodation costs. Employers wishing to agree on a rate with HMRC for overnight accommodation will need to apply using the bespoke rate process.

If travel expenses and related expenses exceed the HMRC limits, they're considered a taxable benefit to your employees. For help avoiding unnecessary high-costs throughout your fiscal year, head to TravelPerk's Guide to Managing Business Travel Expenses.

Can you keep unused per diem payments?

Per diem payments, following the scale-rate payments system managed by HMRC, can be made before or after the employee travels. If made before, the employee has the agreed allowance on hand to spend. If made afterward, they are reimbursed the per diem allowance agreed. In both cases, the amount they receive is fixed, and repayment is not necessary if this fixed amount isn’t spent.

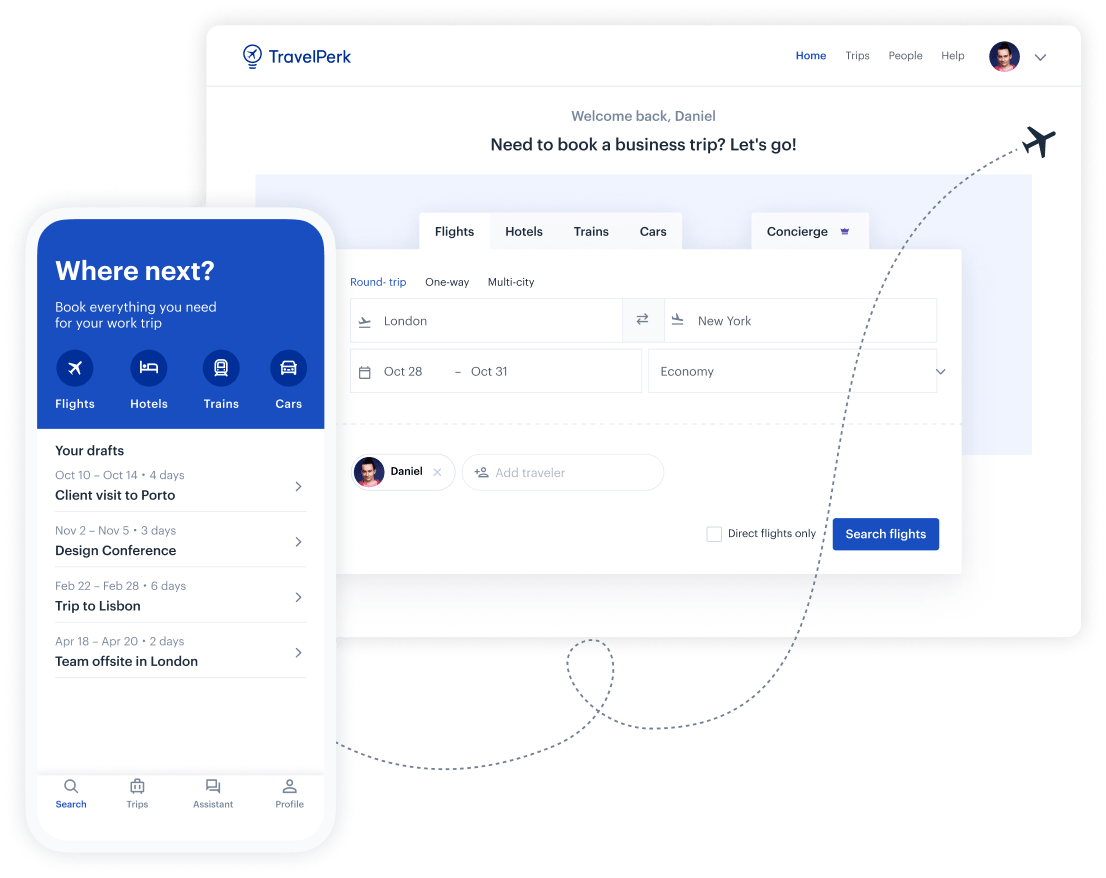

Deciding whether per diem payment rates are your businesses’ best bet is a complicated but essential part of creating a business travel policy. Whether it's a 40-minute train to another office or a business trip to New York City, head to the TravelPerk Corporate Travel Policy Guide for more information and options regarding managing corporate travel.

How is per diem calculated on travel days?

Per diem rates can be determined in many different ways. Travel days are tax-deductible, so a well-thought-through business travel plan is essential for reducing costs.

Travel managers have two options for per diem payments. However the specific of these options vary depending on the country from which the business operates. Essentially, the two options are:

- Standard per diem rates: These are daily allowances determined by the respective regulators in each country. In the UK, this is Homeland Revenue and Customs (HMRC). In the continental United States (CONUS), this is the General Services Administration (GSA).

- Company-determined rates: Company leaders decide what daily rates to offer business travelers. They calculate this based on previous travel expenses and incidental expenses. Once determined, they’re communicated and agreed upon with the relevant governing body.

The first is a ‘one-size-fits-all’ approach that minimizes your company’s finance team’s administrative burden. Just look up the rate and stick to it—pretty simple.

The second allows for flexibility in your plan; however, it’s more of a high-cost option. It also requires data-input that may be hard to scrape together if you haven’t been using a travel management tool. If you can’t find average spends for previous business trips, it will be difficult to assign a company-determined rate.

Using the benchmark rates is quick and easy; however, it can be somewhat restrictive and may not be enough for traveling employees. Agreeing on a rate with the relevant authority provides increased flexibility while still qualifying as tax-deductible but requires more paperwork at first.

Are receipts required for per diem payments?

Nope. Receipts aren’t required for per diem payments in most cases. It’s a major benefit of per diem allowances—they don’t require as much paperwork as traditional expense reports.

If you use the rates set by HMRC, receipts aren’t needed. Employees get the standard rate, decided by what the governing bodies calculate to be the average business travel expenditure per location.

If you plan to agree on a company-specific per diem rate, you’ll need evidence of typical expenses—such as receipts. This is then sent to the governing body, and together you agree on a company-specific rate.

Traditional expense reports for reimbursing traveling employees require a detailed collection of receipts to be submitted to management. Once approved by the travel manager, the accounting team handled the expense report and employee reimbursement.

What about taxation on per diem payments?

One of the major benefits of per diem payments is that they’re tax-deductible for employers. In most cases, per diem payments meet the ‘wholly, exclusively, and necessarily’ test used to determine deductible business expenses.

Per diem rates, both standard and government-agreed specific arrangements, are not considered wages so, therefore, are not taxable. If a per diem rate goes over the standard or agreed amount, it’s considered a taxable benefit to employees. In this case, they must be reported on a P11D form.

Per diem payments may also be skipped altogether in favor of a ‘round sum payment’. These are payments made to employees, and they decide exactly how it’s spent. Round sum allowances are considered taxable income, so they are subject to income tax and national insurance.

When it comes to paying tax on travel expenses, tax brackets vary internationally. If per diem payments exceed the agreed amount, they’re considered extra income and are subject to income tax and national insurance. Check the taxation laws that apply to you for exact figures to avoid any tax non-compliance.

Wrapping up

Per diem payments are a great way to lessen the administrative burden of travel expenses for the traveling employee, management, and finance teams.

Diving deeper really shows how useful per diem rates are to businesses when it comes to tax and paperwork and how they allow flexible travel arrangements for employees.

Per diem rates differ depending on domestic and international travel, as costs vary depending on where your employees are in the world. We’ll be covering foreign per diem rates as part of this TravelPerk per diem allowances guide, so read on for more information.