Travel at ease with an entire support team behind you

Thousands of companies already travel with us Join us

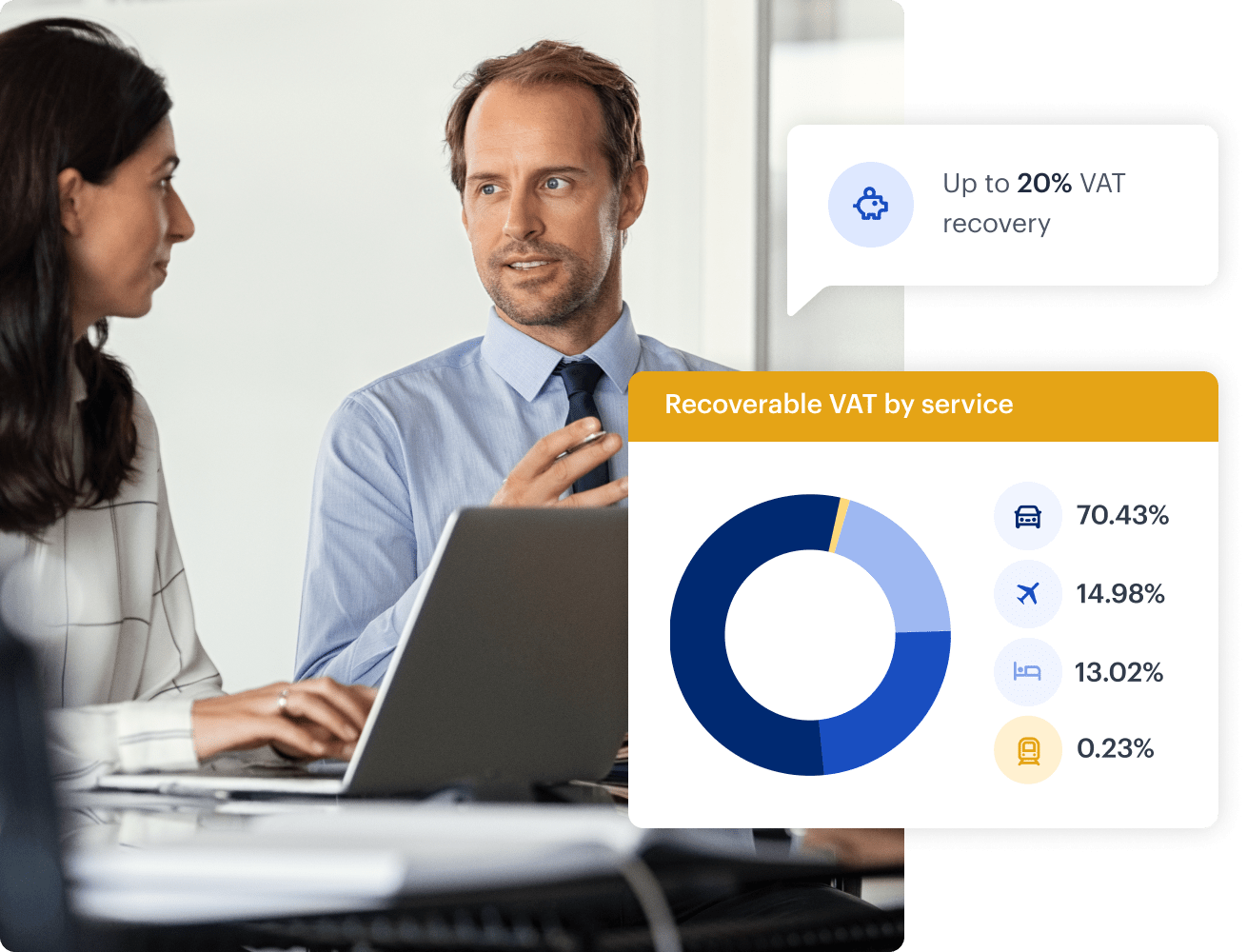

Maximize your VAT recovery and save up to 20% on business travel expenses. With our new quick and painless VAT solution, you won’t leave any money on the table.

Businesses lose billions each year due to unclaimed VAT on travel costs. Avoid long and complicated recovery processes, and save up to 20% of your annual travel budget with the TravelPerk VAT solution. When cash is king, reclaiming VAT can make all the difference.

VAT refunds from business travel expenses can be difficult. There are so many tax regulations both in the UK and in different countries. The refund process is often unclear and confusing. TravelPerk does the heavy lifting for its customers.

By effectively managing business travel VAT refunds, we help businesses like yours to reduce travel costs and admin. Our VAT solution is comprehensive and can optimize your travel spend.

Here’s why thousands of companies have chosen TravelPerk to manage their business travel!

We know what you’re thinking—VAT recovery is a headache. Well, it doesn’t have to be! With our VAT Solution, claiming back money spent on VAT for business travel has never been easier. Say goodbye to lengthy administrative processes, and hello to a quick and smooth way to save yourself time, and your company money.

TravelPerk’s VAT solution is comprehensive. Unlike other providers, we offer a VAT-friendly inventory. This means that when you book a service, you can reclaim VAT with confidence on flights, hotels, cars and trains. Our innovative VAT calculator offers an accurate VAT refund estimate.

We obtain VAT invoices on your behalf from service providers and ensure they are VAT-compliant. TravelPerk does the legwork for you, so you don’t leave cash on the table.

Recovering VAT on foreign travel has never been simpler. Your company doesn’t even need to be registered in the relevant country to reclaim it! We make calculating and recovering VAT quick and easy, and our experts help you understand what you can recover and how to get that money back.

Discover what VAT you can reclaim from business travel expenses. Get in touch to start saving big.

Thousands of companies already travel with us Join us

In short, no. Your business needs to be registered for VAT in order to reclaim it.

Yes. You are not limited to recover VAT on domestic costs, you can recover VAT on travel in countries where you do not have a VAT registration. Your entitlement to recover VAT is based on the rules in the country where the trip takes place. For example, VAT is generally not recoverable on hotel stays in Ireland, and this rule applies the same to an Irish company as it does to a company which is VAT registered in another country e.g. UK company. However, as the rules are based on where the trip takes place that means that the same Irish company could recover VAT on UK hotels. This is because VAT is recoverable on UK hotels (subject to UK VAT rules). By recovering the VAT incurred on trips when employees travel abroad for business you can reduce the cost of travel by between 5% and 25%. The mechanism for recovering foreign VAT is different to recovering domestic VAT but TravelPerk can help you with this process.

In order to recover VAT on business travel, you will need a valid VAT invoice in the name of your company. Without a VAT receipt, a refund is very unlikely.

This depends on the country in which the hotel is located. The VAT rules are different from country to country. TravelPerk can help you calculate the amount of VAT your business can recover on travel related costs.

Yes. You can reclaim all the VAT on fuel if your vehicle is used for business purposes.

You can reclaim VAT on employee travel expenses for business trips, including meals and accommodation. Note that you cannot reclaim VAT if you pay your employees a flat rate for expenses.

TravelPerk maintains a VAT-friendly inventory of services. When you book, you can be confident of claiming a VAT refund from your business travel. We also handle VAT invoice collection and ensures these invoices are VAT-compliant. You can use the VAT calculator to estimate your VAT refund. TravelPerk also has a team of VAT specialists ready to provide extra assistance.